what is a quarterly tax provision

Difficulty gathering and integrating the right data. Did your tax department just wrap up the year-end 2021 income tax provision.

Tcs Under Income Tax Provisions Applicable From 01 10 2020

Reduce Risk Drive Efficiency.

. Provision workpapers will commonly show your current provision deferred provision rate reconciliation state provision etc. This includes federal state local and foreign income taxes. While the provision is the most scrutinized process of the year for most tax departments the time frame to execute is short which can create stress risks of inaccuracy or control failures.

Here is the step-by-step process most often performed by Corporate Tax Department. An income tax provision represents the estimated amount of income tax expense that a company is required to accrue under GAAP for the current year. This tax is required for motor vehicles used designed or maintained for transportation of persons or property and.

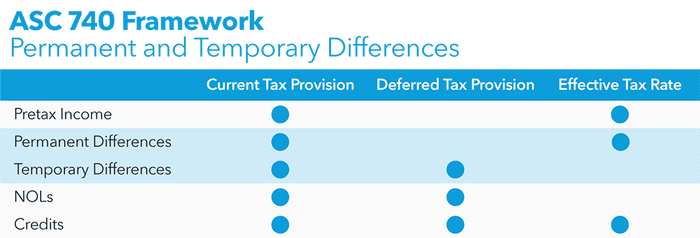

This means that for each financial statement year end ASC 740 requires companies to calculate an effective tax rate and perform. That rate is applied to year-to-date ordinary income or loss in order to compute the year-to-date income tax provision. How much GST did you need to provide for in the first quarter.

Estimated Annual Taxes. What you need to look at is the current provision. To begin the process trial balance data by legal entity is loaded into Tax Provision using Financial Management or another data load tool.

162 Basic method of computing an interim tax provision. Instead of waiting for the traditional tax season during the months of March and April its in your best interest to pay the government in periodic payments. The amount of this provision is derived by adjusting the reported net income of a business with a variety of permanent differences and temporary differences.

Income tax provision Net taxable income before taxes x Applicable tax rates Buffer. Tax provision is the estimated amount of income tax that a company is legally expected to pay the current year. They are prepared in accordance with ASC 740.

Quarterly Estimated Tax Periods means the two three and four calendar month periods with respect to which Federal quarterly estimated tax payments are made. 2 days agoStill the carried-interest tax provision was a relatively small part of the Inflation Reduction Act. Instead of waiting for the traditional tax season during the months of March and April its in.

Join Over 24 Million Businesses In 160 Countries Using FreshBooks. Quarterly Hot Topics is live. Consider applicable tax rates We recommend consulting an accountant for this.

At each interim period a company is required to estimate its forecasted full-year effective tax rate. The amount of this provision is derived by adjusting the firms reported net income with a variety of permanent differences and temporary differences. Ad Proven Asset Management Resources.

Typically this is represented quarterly with each earnings. An income tax provision is the income tax expense that will be reported on the companies financial statements. The ETR is forecast quarterly on a consolidated basis and then applied to year-to-date income.

Most companies report income annually or quarterly so the tax provision amount can only be estimated. See it In Action. Software Trusted by Worlds Most Respected Companies.

Estimate net income for the year. The carrier files a quarterly fuel tax report. The first such period begins on January 1 and ends on March 31.

With quarterly provision filing deadlines approaching learn how to best. All you have to do is divide that total amount into four quarterly payments youll pay to the IRS every three months. Topics covered in this edition.

Forecast full year permanent adjustments to book income- consolidate info from. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. Request Your Demo Today.

ASC 740 mandates a balance sheet approach to accounting. The provision is always calculated on a year-to. Add a small buffer.

This approach combines compliance with accounting and regulatory requirements with adoption of best practices in evaluating risks and controls. The following flowchart details the tax process in Tax Provision. The government is able to generate revenues by implementing the provisions of TDS on the earnings of individuals as well as businesses.

This issue discusses several important tax developments and related ASC 740 considerations. Since you owe more than 1000 in taxes the estimated annual tax is what youre going to base your quarterly taxes on. The third such period begins on June 1 and ends on August 31.

Subtract usable tax credits tax credit carryforwards and the benefit of current year loss carrybacks. To help readers keep pace with the many complexities surrounding this fundamental area of accounting Corporate Income Tax Provision Checklists provides an integrated approach. Us Income taxes guide 162.

The July issue of Accounting for Income Taxes. Divide your estimated total tax into quarterly payments. Adjustments for prior year returns and uncertain tax benefits also apply to an estimated current provision.

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. Comments 1 for question 1 base company tax on 275 of annual profits paid quarterly. Recent editions appear below.

Accounting Business Financial Accounting MATH 12. Is this likely to change throughout the year why. Ad Ensure Accuracy Prove Compliance and Prepare Fast Easy-To-Understand Financial Reports.

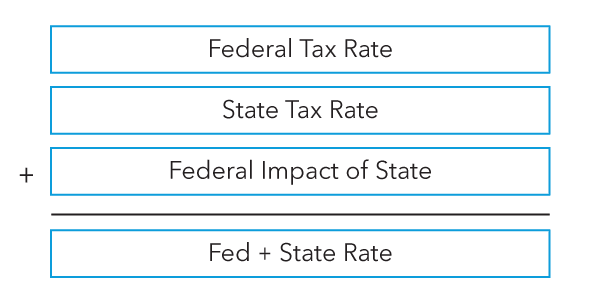

Tax brackets can be more confusing than youd think Multiply the two. Forecast full year US GAAP pretax income- consolidate info from received packages. What was your quarterly tax provision.

The provision can be calculated on a monthly quarterly or annual basis as required. The adjusted net income figure is then. Lawmakers estimated the provision would generate about 14 billion over 10 years compared.

The second such period begins on April 1 and ends on May 31. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. Multiply the result by the tax rate 21 for federal tax on C-corporations.

As a freelancer single business owner or independent worker taxes can get a bit tricky.

2020 Deferred Tax Provision Covid 19 Grant Thornton

Provision For Income Tax Definition Formula Calculation Examples

Provision For Income Tax Definition Formula Calculation Examples

Income Tax Computation For Corporate Taxpayers Prepared By

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

What Is A Tax Provision And How Can You Calculate It Upwork

Bridging The Gaap To Tax The Importance Of The Income Tax Provision

Know Your Taxes The 8 Income Tax Rate

Sales Tax Payable Accounting Basics Upwork

Asc 740 State Income Tax Provision Bloomberg Tax

Tcs Under Income Tax Provisions Applicable From 01 10 2020

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Accounting For Current Liabilities Financial Accounting

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics